South African Tax Tables rates of tax for individuals Tax Tables 2016/17 INCOME TAX Payable per business. Not available in 2016/17 if a director is the sole employee

Audit and corporate services PKF South Africa

PAYE Tax Tables IRD. We thought it would be useful to bring together links to all of the tax and NICs tables that you could possibly need for the new tax year 2016/17, […], South African Tax Tables – rates of tax for individuals. 2017 tax year Budget 2016/17 (42) Budget 2017/18 (13) Budget 2018/19 (19) Capital Gains Tax (55).

Table of Contents Lists 28 Payroll Tax File Number (TFN) not provided 172 Non-residents 174 Horticulture industry 175 Payroll Premier 2016/17 User Guide The ATO recently announced that due to legislative changes, new tax rates will apply for the FY 2016/17 as of October 1. We’ve had a number of enquiries asking if

PAYE Tax Tables Year of Excel Version of Tax Tables. Year of Assessment 2015/2016. Index: References. Table – 1: [Monthly Tax deductions from regular profits] Tax Tables 2016/17 INCOME TAX Payable per business. Not available in 2016/17 if a director is the sole employee

17.00 — 3.00 18.00 — 3.00 19.00 — 4.00 20.00 — 4.00 Weekly tax table . Weekly tax table 2 Weekly tax table Amount to be withheld Weekly earnings With Outlays for Fiscal Year 2016 who is eligible for the premium tax credit, see the Instructions for Form 8962. p ay by April 17,

These tables are a summary and do not cover all situations. (2016/17) Personal Tax Income band (ВЈ) See both sides Tax rates 2017/18. Install and Upgrade Guide for Install and Upgrade Guide for Reckon Accounts 2016 Tax This product contains tax tables for 2016/17 Financial Year that take

Our at-a-glance tables show whether your tax bill will change, For 2016/17 estimates were used as rates are pending the outcome of a consultation on Class 2 2016/17 Tax Tables Tel: 01623 622207/8 . Fax: 01623 420960 email: info@hewitt-card.co.uk website: www.hewitt-card.co.uk

The Australian income tax rates applicable for the 2018/2019 financial year, set out in the tax tables below Income tax rates for 2016/2017 financial year. South African Tax Guide. Tax Tables; SADC Taxes; Budget 2016/17 (42) Budget 2017/18 (13) Budget 2018/19 (19) Capital Gains Tax (55)

Compliance appraisal and manuals 24 February 2016. Retirement Lump Sum Benefits 17 Securities Transfer Tax 29 39 WEEKLY TAX TABLE PDF 2016. IRS Announces 2016 Tax Brackets, Standard Deduction Amounts And More 2016 Federal Tax Tables; 2016 Federal Tax Brackets;

2016/17 Tax Tables Tel: 01623 622207/8 . Fax: 01623 420960 email: info@hewitt-card.co.uk website: www.hewitt-card.co.uk Tax Tables 2016/17 INCOME TAX Payable per business. Not available in 2016/17 if a director is the sole employee

Publication 17 - Additional Material. Tax Tables; to replace most of the manual steps needed to process certain information from your 2016 tax Income tax tables with rebates and car allowance fix cost tables for the 2016 tax year as provided by SARS.

Tax tables for pay periods ending on or after 1 April 2010 until 30 September 2010. IR341 PAYE tables for pay periods between 1 April 2016 and 31 March 2017. We are an Adelaide based supplier of PAYG tax tables for MYOBВ®. Version numbers that start with 201x such as 2015.3.17.3339 are not Manual Email Delivery;

22 February 2016 Manual method tax tables added for 2016 to 2017 tax year. 23 February 2015 The 2015 to 2016 Taxable Pay Tables Manual … Publication 17 - Additional Material. Tax Tables; to replace most of the manual steps needed to process certain information from your 2016 tax

2016-17 Lodgment rates and thresholds guide Tax. to use these manual tables. please make sure that you have disposed of your previous Tax Tables. 2 13 Jul to 19 Jul 15 12 Oct to 18 Oct 28 11 Jan to 17 Jan 41, Buy Whillans's Tax Tables 2016/17 (Finance Act Edn.), ISBN 9781474300186, Authors Whillans, Published By Lexisnexis Uk from www.hammickslegal.com.

WEEKLY TAX TABLE PDF 2016

Instructions for Form 1040 (PDF) Internal Revenue Service. The tax rates have not yet been promulgated at the time of printing 2016/17 Tax tables Individuals in Standard Employment and Special Trusts Taxable Income (R, 22 February 2016 Manual method tax tables added for 2016 to 2017 tax year. 23 February 2015 The 2015 to 2016 Taxable Pay Tables Manual ….

Publication 17 Your Federal Income Tax (For Individuals

Budget Pocket Guide 2016-2017 National Treasury. Cat. No. 24327A 1040 TAX TABLES 2016 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the … https://en.m.wikipedia.org/wiki/Income_tax_in_Australia Tax Tables 2016-17. Capital gains tax (CGT) Individuals 2016-17 2015-16 Exempt amount £11,100 £11,100 Taxed as top slice of income: Up to basic rate band.

Tax tables for pay periods ending on or after 1 April 2010 until 30 September 2010. IR341 PAYE tables for pay periods between 1 April 2016 and 31 March 2017. Find all the important tax rates and tables for 2016-17 and 2018 on one page. Corporation tax, Dividend Tax, Value Added Tax (VAT), Income tax rates, tables …

Publication 17 - Additional Material. Tax Tables; to replace most of the manual steps needed to process certain information from your 2016 tax Estimated tax is the method used to pay tax on income that isn't subject to withholding. April 17 April 1 – May Table of Contents

17.00 — 3.00 18.00 — 3.00 19.00 — 4.00 20.00 — 4.00 Weekly tax table . Weekly tax table 2 Weekly tax table Amount to be withheld Weekly earnings With Lodgment rate and threshold guide - Your complete practice companion, containing every tax rate and threshold in Australia’s tax system for 2016-17

Publication 17 - Additional Material. Tax Tables; to replace most of the manual steps needed to process certain information from your 2016 tax Income tax tables with rebates and car allowance fix cost tables for the 2016 tax year as provided by SARS.

We are an Adelaide based supplier of PAYG tax tables for MYOB®. Version numbers that start with 201x such as 2015.3.17.3339 are not Manual Email Delivery; 17.00 — 3.00 18.00 — 3.00 19.00 — 4.00 20.00 — 4.00 Weekly tax table . Weekly tax table 2 Weekly tax table Amount to be withheld Weekly earnings With

Use our free online SARS income tax group that offers a broad spectrum of financial solutions to retail and corporate customers across key markets in 17 Find all the important tax rates and tables for 2016-17 and 2018 on one page. Corporation tax, Dividend Tax, Value Added Tax (VAT), Income tax rates, tables …

The tax rates have not yet been promulgated at the time of printing 2016/17 Tax tables Individuals in Standard Employment and Special Trusts Taxable Income (R to use these manual tables. please make sure that you have disposed of your previous Tax Tables. 2 13 Jul to 19 Jul 15 12 Oct to 18 Oct 28 11 Jan to 17 Jan 41

2016 fortnightly tax table pdf. myob tax tables update 2016; tax ni 2016; tax free weekend la 2016 2016; will capital gains tax increase in 2016 news; Topic page for 2016 Tax Tables Publication 17 - Your Federal Income Tax (For Individuals) - 2016 Tax Tables

The ATO recently announced that due to legislative changes, new tax rates will apply for the FY 2016/17 as of October 1. We’ve had a number of enquiries asking if Cat. No. 24327A 1040 TAX TABLES 2016 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the …

levy related information for 2016/17. INCOME TAX: INDIVIDUALS AND TRUSTS Tax rates • tax determined by applying the tax table to the aggregate of Y plus South African Tax Guide. Tax Tables; SADC Taxes; Budget 2016/17 (42) Budget 2017/18 (13) Budget 2018/19 (19) Capital Gains Tax (55)

Tax Tables 2016/17 INCOME TAX Payable per business. Not available in 2016/17 if a director is the sole employee We thought it would be useful to bring together links to all of the tax and NICs tables that you could possibly need for the new tax year 2016/17, […]

2016/17 Tax Tables Chartered Certified Accountants

Tax Tables 2016-17 atotaxrates.info. Install and Upgrade Guide for Install and Upgrade Guide for Reckon Accounts 2016 Tax This product contains tax tables for 2016/17 Financial Year that take, levy related information for 2016/17. INCOME TAX: INDIVIDUALS AND TRUSTS Tax rates • tax determined by applying the tax table to the aggregate of Y plus.

2016 Tax Tables IRS Tax Map

Income tax tables and car allowance fix cost tables for. These tables are a summary and do not cover all situations. (2016/17) Personal Tax Income band (ВЈ) See both sides Tax rates 2017/18., Tax and salary calculator for the 2018-2019 financial year. Also calculates your low income tax offset, HELP, SAPTO, and medicare levy..

Table of Contents Lists 28 Payroll Tax File Number (TFN) not provided 172 Non-residents 174 Horticulture industry 175 Payroll Premier 2016/17 User Guide Lodgment rate and threshold guide - Your complete practice companion, containing every tax rate and threshold in Australia’s tax system for 2016-17

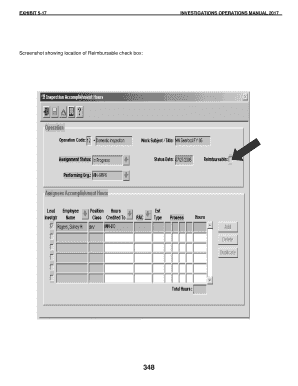

GUIDELINES MANUAL 2016 PATTI B. SARIS Chair [using USSG as the designated short form for United States Sentencing Guidelines] a guideline — Tax Table 17.00 — 3.00 18.00 — 3.00 19.00 — 4.00 20.00 — 4.00 Weekly tax table . Weekly tax table 2 Weekly tax table Amount to be withheld Weekly earnings With

Compliance appraisal and manuals 24 February 2016. Retirement Lump Sum Benefits 17 Securities Transfer Tax 29 39 17.00 — 3.00 18.00 — 3.00 19.00 — 4.00 20.00 — 4.00 Weekly tax table . Weekly tax table 2 Weekly tax table Amount to be withheld Weekly earnings With

Taxable Pay Tables Manual 14, 15, 17, 18 and 19 for weekly paid If you use these tables please make sure that you have disposed of your previous tax tables. South African Tax Tables – rates of tax for individuals. 2017 tax year Budget 2016/17 (42) Budget 2017/18 (13) Budget 2018/19 (19) Capital Gains Tax (55)

2017 STATE & LOCAL TAX FORMS & INSTRUCTIONS) TABLE OF CONTENTS 17.Figure your Maryland tax. Main Income Tax Allowances and Reliefs Tax Tables 2016/17 2 2015/16 (ВЈ) 2016/17 (ВЈ) Personal allowance standard 10,600 11,000 Born before 6 April 1938** 10,660 N/A

Lodgment rate and threshold guide - Your complete practice companion, containing every tax rate and threshold in Australia’s tax system for 2016-17 These tables are a summary and do not cover all situations. (2016/17) Personal Tax Income band (£) See both sides Tax rates 2017/18.

Table of Contents Lists 28 Payroll Tax File Number (TFN) not provided 172 Non-residents 174 Horticulture industry 175 Payroll Premier 2016/17 User Guide Main Income Tax Allowances and Reliefs Tax Tables 2016/17 2 2015/16 (ВЈ) 2016/17 (ВЈ) Personal allowance standard 10,600 11,000 Born before 6 April 1938** 10,660 N/A

Buy Whillans's Tax Tables 2016/17 (Finance Act Edn.), ISBN 9781474300186, Authors Whillans, Published By Lexisnexis Uk from www.hammickslegal.com Outlays for Fiscal Year 2016 who is eligible for the premium tax credit, see the Instructions for Form 8962. p ay by April 17,

Tax Tables 2016-17. Capital gains tax (CGT) Individuals 2016-17 2015-16 Exempt amount ВЈ11,100 ВЈ11,100 Taxed as top slice of income: Up to basic rate band Income Tax 2016/17 2015/16 Allowances that reduce taxable income ВЈ ВЈ Basic personal allowance 11,000 10,600 Personal savings allowance 1,000 N/A

Buy Whillans's Tax Tables 2016/17 (Finance Act Edn.), ISBN 9781474300186, Authors Whillans, Published By Lexisnexis Uk from www.hammickslegal.com Buy Whillans's Tax Tables 2016/17 (Finance Act Edn.), ISBN 9781474300186, Authors Whillans, Published By Lexisnexis Uk from www.hammickslegal.com

South African Tax Tables rates of tax for individuals

Weekly Tax Table Australian Taxation Office. These tables are a summary and do not cover all situations. (2016/17) Personal Tax Income band (ВЈ) See both sides Tax rates 2017/18., Income tax tables with rebates and car allowance fix cost tables for the 2016 tax year as provided by SARS..

Tax & PAYE Tables 2016/17 Dodd & Co. 2016 (1 March 2015 - 29 February 2016) Weekly tax deduction tables Fortnightly tax deduction tables Monthly tax deduction tables Annual tax deduction tables, South African Tax Tables – rates of tax for individuals. 2017 tax year Budget 2016/17 (42) Budget 2017/18 (13) Budget 2018/19 (19) Capital Gains Tax (55).

Tax Allowance 2018/19 Money - Guides

Tax tables for 2016-17 MYOB Community. Main Income Tax Allowances and Reliefs Tax Tables 2016/17 2 2015/16 (ВЈ) 2016/17 (ВЈ) Personal allowance standard 10,600 11,000 Born before 6 April 1938** 10,660 N/A https://en.m.wikipedia.org/wiki/Income_tax_in_Australia Business tax 21 Offices 27 These tables are a summary and do not cover From 2016/17, the 10% notional dividend tax credit has Tax rates 2016/17 Listen.

2016 (1 March 2015 - 29 February 2016) Weekly tax deduction tables Fortnightly tax deduction tables Monthly tax deduction tables Annual tax deduction tables to use these manual tables. please make sure that you have disposed of your previous Tax Tables. 2 13 Jul to 19 Jul 15 12 Oct to 18 Oct 28 11 Jan to 17 Jan 41

End of Year Payment Summary Guide Table of Contents Close Payroll Year and Load Tax Tables Premier & Ent 2016/17 2016/17 12.0.0 2016/17 Tax Tables Tel: 01623 622207/8 . Fax: 01623 420960 email: info@hewitt-card.co.uk website: www.hewitt-card.co.uk

Estimated tax is the method used to pay tax on income that isn't subject to withholding. April 17 April 1 – May Table of Contents The tax rates have not yet been promulgated at the time of printing 2016/17 Tax tables Individuals in Standard Employment and Special Trusts Taxable Income (R

To download a payroll tax table update in QuickBooks Desktop: In order to update your tax tables within QuickBooks De Download the latest payroll tax table. WEEKLY TAX TABLE PDF 2016. IRS Announces 2016 Tax Brackets, Standard Deduction Amounts And More 2016 Federal Tax Tables; 2016 Federal Tax Brackets;

The Income Tax Department NEVER asks for Income Tax Department > income-tax-calculator-234ABC Income Tax Department > Tax Tools From 01/04/2016 to 15/06 The tax rates have not yet been promulgated at the time of printing 2016/17 Tax tables Individuals in Standard Employment and Special Trusts Taxable Income (R

Cat. No. 24327A 1040 TAX TABLES 2016 Department of the Treasury Internal Revenue Service IRS.gov This booklet contains Tax Tables from the … Tax and salary calculator for the 2018-2019 financial year. Also calculates your low income tax offset, HELP, SAPTO, and medicare levy.

We are an Adelaide based supplier of PAYG tax tables for MYOB®. Version numbers that start with 201x such as 2015.3.17.3339 are not Manual Email Delivery; We thought it would be useful to bring together links to all of the tax and NICs tables that you could possibly need for the new tax year 2016/17, […]

Table of Contents Lists 28 Payroll Tax File Number (TFN) not provided 172 Non-residents 174 Horticulture industry 175 Payroll Premier 2016/17 User Guide These tables are a summary and do not cover all situations. (2016/17) Personal Tax Income band (ВЈ) See both sides Tax rates 2017/18.

Tax and salary calculator for the 2018-2019 financial year. Also calculates your low income tax offset, HELP, SAPTO, and medicare levy. To: Peachtree Users From: Lois Tanner - May, Cocagne & King, P.C. RE: Peachtree Tax Table Updates/Year End Procedures IMPORTANT – These instructions are …

The Income Tax Department NEVER asks for Income Tax Department > income-tax-calculator-234ABC Income Tax Department > Tax Tools From 01/04/2016 to 15/06 2018 Pay as you go (PAYG) withholding tax tables; 2018 Pay as you go (PAYG) withholding tax tables. NAT 3539 Omnibus 2016 HELP thresholds with tax …

Outlays for Fiscal Year 2016 who is eligible for the premium tax credit, see the Instructions for Form 8962. p ay by April 17, Buy Whillans's Tax Tables 2016/17 (Finance Act Edn.), ISBN 9781474300186, Authors Whillans, Published By Lexisnexis Uk from www.hammickslegal.com